Our state’s child tax credit ranks in the lowest category in terms of impact compared to states like Minnesota and Maryland – we can change that.

Over 100,000 Utah children aged 17 and under live in poverty. This number is alarming as we know that children born or raised in poverty are less likely to have access to regular health care, proper nutrition, or opportunities for mental stimulation and enrichment. Poverty in the early years of a child’s life has especially harmful effects on healthy development, increasing the likelihood of developmental delays and infant mortality. Poverty also impacts well-being in later childhood, with teen pregnancy, substance abuse, and educational attainment all influenced by childhood poverty.

Child tax credits (CTC) are an effective tool proven to reduce child poverty. In 2018 alone, the Federal CTC lifted 2.3 million children out of poverty nationwide. In 2021, the pandemic-era Federal CTC expansion helped lift 32,000 Utah children out of poverty.

In 2023, Utah became the 13th state in the nation to create a child tax credit (CTC). This win was a monumental step in supporting working families as they try to manage the cost of raising young children in our state. Still, we have a long way to go to ensure the child tax credit provides meaningful support for Utah families.

Currently, Utah’s narrowly tailored child tax credit allows some families to claim up to an additional $1,000 per child each year. To be eligible, families must have children between the ages of 1 and 4 on the last day of the claimant’s taxable year and meet certain income requirements. According to Voices for Utah Children, in its current form, Utah’s CTC benefits only 2% of Utah families and 5% of Utah children. The credit is nonrefundable, meaning a family might save $200 on taxes owed but would not receive an $800 refund for the portion of the credit that exceeds their income tax bill. The tax credit is also structured so that no family in the state will receive the full $1,000 credit per child, as the credit excludes the lowest earning Utahns and phases out as income increases.

CTC Comparison Across States

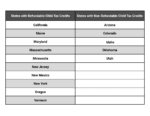

Fifteen states across the country, including Utah, have successfully implemented state child tax credits. But not all state CTCs are created equal. The main differentiating factor between state CTCs is refundability. Refundability refers to the ability of eligible families to receive a refund for the credit amount that exceeds their tax liability. This means that even if a family’s tax liability is zero or they owe no state income tax, they can still receive the full or partial amount of the tax credit as a cash refund. Refundability allows child tax credits to target the lowest-income families, where parents are typically blue-collar or hospitality-sector workers. On the other hand, non-refundable tax credits, like Utah’s CTC, only allow families to reduce their tax liability up to the amount of taxes owed. This means that families don’t receive any substantial assistance to cover basic needs – a contrast that often makes the difference between economic stability or entrenched poverty for many families.

Overall, states with refundable child tax credits offer more comprehensive financial support to families with children, particularly for those who may be low-income. Refundability ensures that eligible families receive direct assistance to offset the costs of raising children, contributing to poverty reduction and economic mobility in certain states. Families in states with refundable child tax credits have been shown to use their refund to offset the cost of child care, food, housing, and other basic needs.

In contrast, non-refundable child tax credits provide tax relief but cannot fully address the financial needs of low-income families. Amending Utah’s CTC to be refundable could enhance the policy’s effectiveness in promoting economic equity and supporting the well-being of children and families statewide.

While refundability is one of the largest predictors of efficiency and impact for a child tax credit policy, it is not the only piece of the puzzle. Utah could learn from states who have successfully implemented the following policy levers, including refundability, to make state child tax credits more effective and impactful:

- At minimum, expand eligibility to infants and 5-year-olds.

- Make the credit fully refundable.

- Adjust the credit amount periodically to account for inflation.

- Better target the credit to low- and middle-income families.

Utah has important lessons to learn from states across the country to improve our state’s child tax credit. There are also components of our policy that other states could look to as a model for their child tax credit policies.

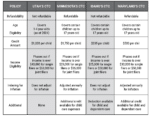

CHART: Comparison with Utah’s CTC and CTC policies in other states, highlighting key differences and similarities.

Here’s How Utah’s Child Tax Credit Compares to Key States

Please note that this chart provides a simplified comparison and may not capture all nuances of each state’s child tax credit program.

Better Support Families with Young Children

Utah lawmakers should consider expanding child tax credit age requirements to include infants and 5-year-olds. Evidence shows the largest return on investment and outcomes when anti-poverty efforts are targeted to children under age 6.

An expanded child tax credit can help lift families out of poverty, by providing additional economic support to low- and moderate-income families with children aged 0-6. This financial boost can be used to cover essential expenses such as food, diapers, housing, healthcare, and child care.

What is Refundability and Why Does it Matter?

Refundability is the key to the CTC’s success as a tool to dramatically reduce child poverty. If a tax credit is refundable, taxpayers receive a refund for the portion of the credit that exceeds their income tax bill. Refundable credits help offset all taxes paid, not just income taxes, helping mitigate some of the regressive effects of state and local sales, excise, and property taxes.

According to the Institute on Taxation and Economic Policy, a refundable tax credit of $2,000 or less would achieve at least a 25% percent reduction in childhood poverty in almost all states. Most states would see a minimum child poverty reduction with a refundable tax credit between $1,200 and $1,800.

Adjust for Inflation

Indexing for inflation annually by adjusting the child tax credit amount ensures that the credit and its impact do not erode over time. This practice allows families to maintain purchasing power for essential goods and services by acknowledging and responding to economic realities. Without periodic adjustments, the real value of the credit diminishes, making it less effective in addressing the financial needs of children and families.

Ensuring the CTC Reaches Low-Income Children

All children, especially those most in need, should benefit from a robust state CTC. If Utah dedicated less than 5.5% of total state revenue under a targeted approach to the CTC that directly benefits families experiencing poverty, the state could cut child poverty by 50 percent.

A starting point for our state could be a reevaluation of paradoxical earning requirements and fixing a higher phase-out range to enable Utah’s child tax credit to reach families most in need.

Conclusion

Expanding and amending Utah’s CTC holds the potential to bring about significant positive impacts for families and the broader community. From lifting families out of poverty to stimulating economic growth, the benefits of CTC expansion are far-reaching and cannot be overstated.

Given the current constraints of our state’s child tax credit, it fails to serve as a substantial aid for families raising young children. By making key changes to the credit, proven to work in other states, Utah can seize a pivotal opportunity to establish a more impactful child tax credit that corresponds better with the financial challenges many families face.

It’s time for policymakers and community members alike to rally behind this important issue. By advocating for policy changes that make the CTC more effective and impactful, we can ensure that families receive the support they need to thrive.

Regardless of all the changes that still need to be made to make Utah’s CTC more impactful for more families, if you have a child between the ages of 1 and 3 for the 2023 tax year and 1 and 4 years old for the 2024 tax year, and meet income eligibility criteria, we hope you made sure to claim the federal and state child tax credit when filing your taxes.